28+ Volatility calculator online

Calculate the probability of future stock prices for SPY using current prices and volatility over time intervals. Our calculator is intended as a guide only and only relates to your KiwiSaver account.

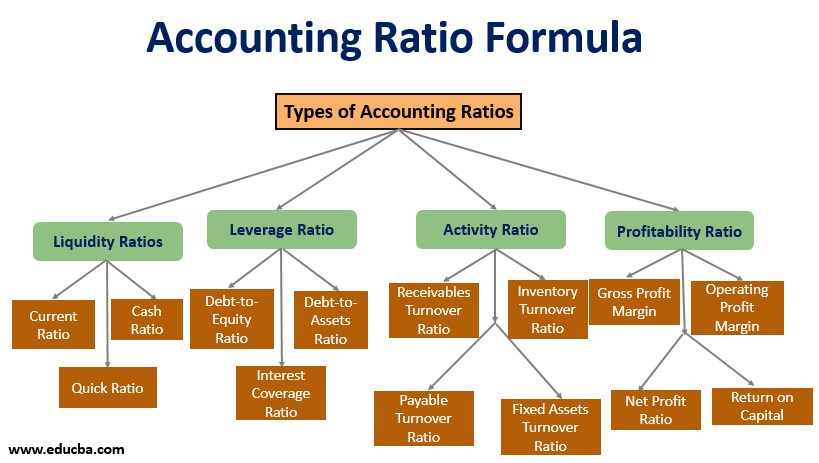

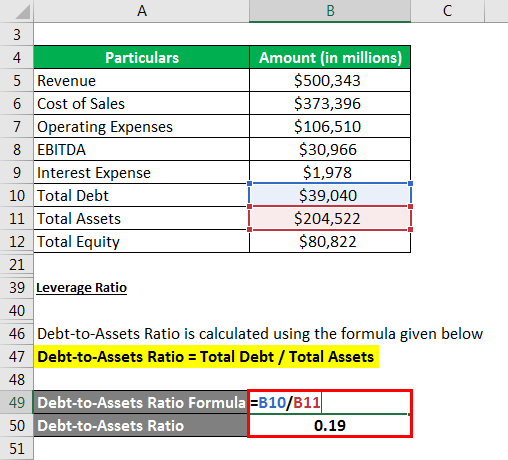

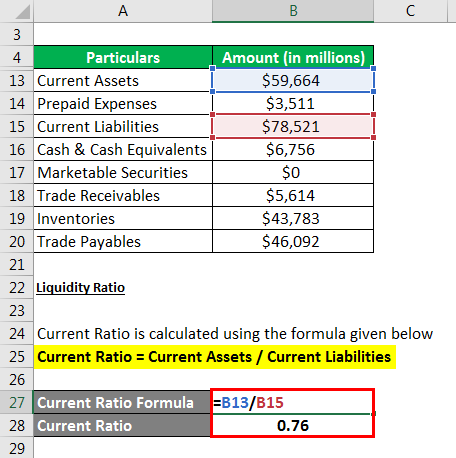

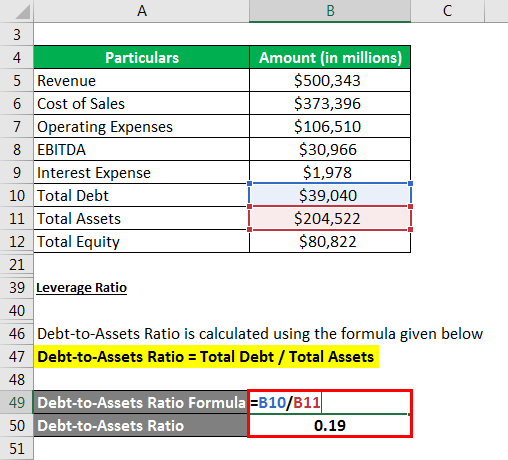

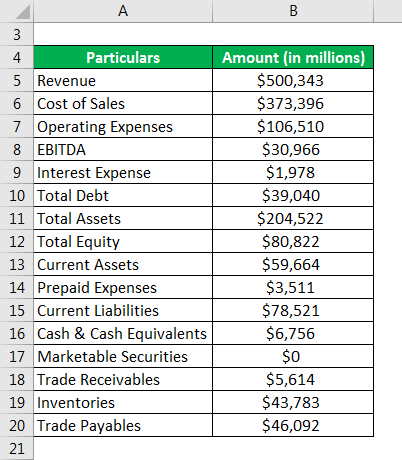

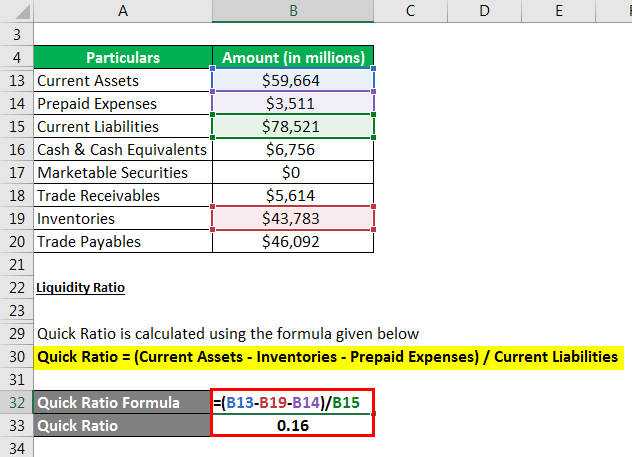

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Calculate returns on Mutual Funds SIP using INDmoneys SIP Calculator online.

. How To Calculate Your Front End Debt-To-Income Ratio DTI. The calculator will compute probabilities regardless of whether an actual contract with matching price strike. It is very important for us to increase the margins for a very different reason.

WC Wind Chill F 3574 06215 T - 3575 V 016 04275 T V 016 Where. 100x Options Profit Calculator. Let us now use the option calculator to calculate the volatility of the underlying.

Adjust for Inflation Include Dividends. Our free online Annual Salary Calculator allows you to convert your hourly wage into its yearly quarterly monthly weekly and daily equivalents. Volatility is the rate at which the price of the main indices market or a security changes on a daily basis.

This currency rates table lets you compare an amount in British Pound to all other currencies. We also provide you with Working Capital Calculator with a downloadable excel template. Calculator assumptions Industry-standard forecast rates of return after fees and tax at 28 as set by the FMA across four main fund types.

Option Calculators and Stock Screeners. DAX New Volatility Discussions Feb 12 2020 2218 Operators and equipment manufacturers cancellling Mobille World Congress participation in Barcelona due to virus. Board Options Exchanges CBOE Volatility Index VIX.

Therefore over a long period of time the cost of units. The SP 500 recovered on Wednesday after losing ground in the prior three sessions. Investors receive more units when the NAV of a mutual funds fall and less units when NAV of mutual funds rise.

Dates shown for bear markets are based on price declines of 20 or more without dividends reinvested in the unmanaged SP 500 with at least 50 recovery between declines. End August On Weak Note Amid Low Volatility. Short term loans Advances.

Stocks closed mostly higher on Wednesday ahead of the Federal Reserves Jackson Hole conference. To do this I leave the Volatility field blank highlighted in blue and select Volatility highlighted in red option. We cannot change the cycles and that means the volatility will stay but what we can do is dilute the volatility by going for businesses which deliver higher margin percentage so that we stay iconic but are also most profitable.

You may also look at the following articles to learn more. As a rule of thumb lenders are looking for a front ratio of 28 percent or less. Volatility is also referred to as the increasing price of the stock which investors do not generally associate with risk.

However when the market or stock prices fluctuate rapidly with a negative trend it haunts the financial market due to the loss in value. The Wind Chill Calculator uses the following formulas to calculate the wind chill factor. Our business is very cyclical.

Amortization Formula in Excel With Excel Template Amortization Formula. Class F-2 and R-6 shares with all distributions reinvested. If you find use out of our wage conversion calculator why not add a widget version of it to your website.

By Lisa Levin Benzinga Editor. Marginal Product of Labor Formula. This calculator lets you find the annualized growth rate of the S.

Check Lumpsum Returns Check SIP Returns Try Another Calculator Advisorkhoj develops innovative mutual fund research tools and Calculators that may help you in your investments. No need to worry about market volatility. View fund expense ratios and returns.

102017 as expiry dates shaving of the 2 day trading holiday option call price reflects to 2781settlement price is 2845. Jan 1 to Dec 31. The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry.

Youll find that the CAGR is usually about a percent or two less than the simple average. September 1 2022 628 AM. Amortization Formula Table of Contents.

The Position Size Calculator will calculate the required position size based on your currency pair risk level either in terms of percentage or money and the stop loss in pips. Year and Return Date Range. More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables.

Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero. Back end ratio looks at your non-mortgage debt percentage and it should be less than 36 percent if you are seeking a loan or line of credit.

Risk Management And Risk Reward Ratio Rules Risk Reward Risk Management Technical Analysis Charts

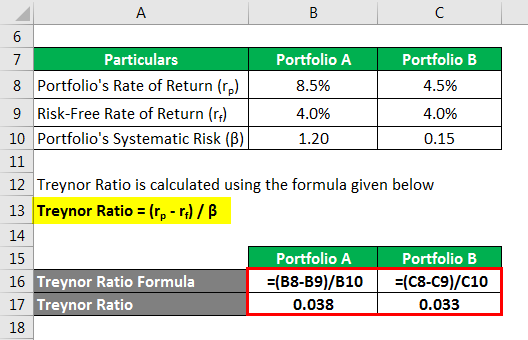

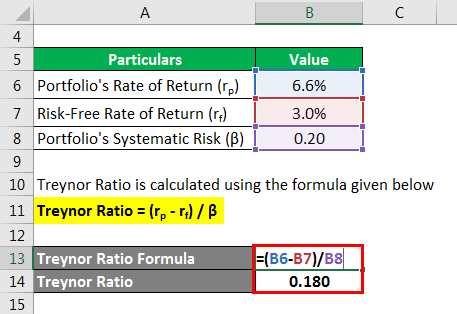

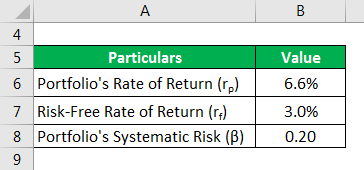

Treynor Ratio Examples And Explanation With Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

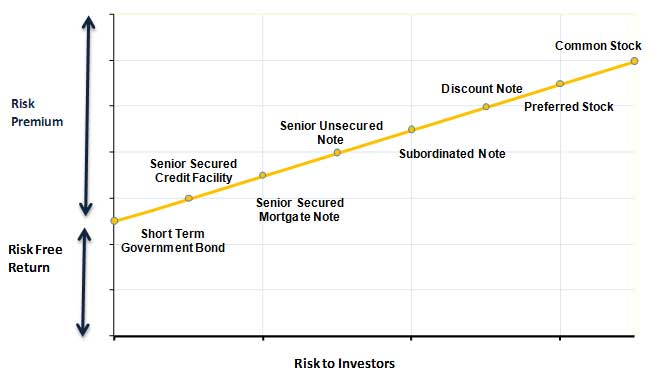

The Valuable Estimation Of Cost Of Equity Through Risks Educba

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

How Does My Investment Portfolio Look Like Quora

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies

Ex 99 1

Trading Pro System Implied Volatility Weekly Options Trading Standard Deviation

Ex 99 1

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Michael Hart Mikehart79 Twitter Implied Volatility Practice Management Michael

Treynor Ratio Examples And Explanation With Excel Template

Treynor Ratio Examples And Explanation With Excel Template

Pin On Financial Trading

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula