Va home loan pre approval calculator

Use this calculator to help estimate the monthly payments on a VA home loan. The next section covers some big-time dos and donts.

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Find the best mortgage with Guaranteed Rate.

. VA home loans are available exclusively to qualifying active-duty service members veterans reserve members National Guard members and eligible surviving spouses. The loan program you choose can affect the interest rate and total monthly payment amount. New first mortgage refinance or purchase applications submitted between August 29 2022 12AM PST through September 13 2022 1159 PM PST are eligible for the promotion.

In the time between pre-approval and closing borrowers should be very careful with their money and financial activities in general. 2 PenFed is offering a 300 Visa Prepaid Card to all members who submit and fund their eligible mortgage transactions. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice.

Meet the VAs standard minimum property. Your Guide To 2015 US. Another veteran who has VA loan entitlement can be a co-borrower as long as this person will live in the home with you as his or her primary residence.

The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. Enter your closing date the sale price your military status quickly see the monthly costs of buying a home. The pre-approval letter will typically inform you of the loan amount loan program loan term and the interest rate you qualify for if certain conditions.

Even better a VA mortgage does not require monthly private mortgage insurance which could result in hundreds of dollars in savings annually. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility.

We have done extensive research on the FHA Federal Housing Administration and the VA Department of Veterans Affairs One-Time Close Construction loan programs. A seller often wants to see a mortgage pre-approval letter and in. This is a one-time payment which is 23 of the total loan amount for first-time VA borrowers and 36 for people who have previously used the VA home loan program.

You can also give us a call at 833 326-6018. Navy Federals standout feature are its low interest rates which. Here are the latest ones.

Mortgage loan basics Basic concepts and legal regulation. Department of Veterans Affairs VA loans are. Use Bankrates loan prequalification calculator to determine your ability to qualify for a home or auto loan.

If you feel like youre ready apply for a VA loan with Rocket Mortgage today. 1 Other fees may apply such as discount points to buy down your rate. This complex meets the VAs guidelines and you could buy a unit with a VA loan.

For many who qualify the VA loan program is the best possible mortgage. Once you are pre-approved for a mortgage the lender will provide you with a pre-approval letter that acts as a conditional commitment to loan you a specific amount of money for a home purchase. VA approval is required for this type of setup unless the veteran happens to be your spouse.

Theyll face the same credit and financial scrutiny as a spouse. Navy Federal Credit Union is a financial institution that offers low rates and financial incentives to military families. Viewed the same as a stick build traditional homes by lenders around the country this property style could allow you to save money decrease build time and get a great home at a cheaper rate than Manufactured Homes Eligible on our FHA VA Construction Loan ProgramPrefab Modular Homes are usually built.

Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. The VA home loan. A VA loan is an important benefit earned by our military.

In this case you can see the New Bern Condominium complex has been Accepted Without Conditions as of July 30 2021. Pre-Approval Dos and Donts. The VA updated its rules for how it categorizes manufacturedmobile homes in March 2019.

Why we chose it. Unbeatable benefits for veterans. Fannie Mae HomePath.

For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. YES One-Time Close - True Prefabricated Modular Homes. Receive a pre-approval letter.

However many things that can change the makeup of a pre-approval are within your control. To be eligible for a VA loan the mobile home must. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Backed by the US. Use the Home Purchasing Power Calculator to find out what you can afford estimate your monthly payment and set a down payment goal. If you qualify you can get a great interest rate with no money down which means homeownership can be more affordable with a VA home loan.

We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. VA Home Loan Calculator Estimate Your Payments on VA Home Loans Your Total Closing Costs. A combination of low fees several loan assistance programs and a wide selection of mortgage loans make Navy Federal Credit Union our best VA loan lender overall.

Let Bankrate a leader. Homeowner Tax Deductions. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more.

Start here Sep 11th 2022 VA condo approval types. Keep financial behavior steady. VA borrowers who put 5 down.

Going through the pre-approval process with several lenders allows a homebuyer to shop mortgage rates and find the best deal. Find A Home - With your pre-approval in hand you can finally. Click here to check todays low VA loan rates and request a mortgage pre-approval Sep 12th 2022 VA mobile home guidelines.

Can I qualify for a VA home loan. September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt. Use our digital mortgage application to buy or refinance your home.

Check your eligibility for a VA home loan.

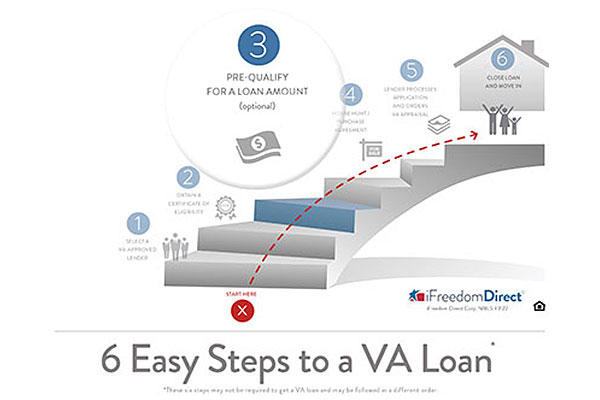

Step By Step To A Va Loan 3 Prequalifying Military Com

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Millions Of Veterans Have Already Used This Benefit See What The Va Loan Can Do For You Mortgage Loans Va Loan Refinance Mortgage

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Va Loan Funding Fee Closing Cost Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Downloadable Free Mortgage Calculator Tool

Downloadable Free Mortgage Calculator Tool

Home Affordability Calculator For Excel

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Va Loan Funding Fee Closing Cost Calculator

Va Loan Calculator

Discount Points Calculator How To Calculate Mortgage Points

Mortgage Pre Approval Calculator

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

Va Loan For A Second Home How It Works Lendingtree

Va Mortgage Calculator Calculate Va Loan Payments